Learn how data analytics can help you catch procurement fraud indicators early, before it ends up impacting your bottom line.

Picture this: It’s a beautiful Friday morning, the birds are singing, and the sun is shining. You’re thrilled that you have just one more day until the weekend. You’re a city or county auditor, and you’ve just sat down to enjoy a dark and beautifully aromatic cup of coffee that’s brewed to perfection.

You open the local news and the headline reads, “[Your] City Hall Contractor Bribery Scandal.” Wait, what? Your zen-blissful morning has now been replaced with a terrible sinking feeling in your stomach. The last place you want to learn about fraud in your organization is from a newspaper.

Hopefully, you’ve never experienced this situation. Unfortunately, for many cities and counties, headlines like this have become a reality. All levels of government rely on third-party contractors to provide a variety of services, ranging from construction to social services. Contracted services can be especially effective for specialized, seasonal, or short-term work that would otherwise be cost prohibitive to keep on the payroll.

In the next few years, government contracting is expected to increase. A hiring freeze on staff and election promises to decrease the existing workforce could, by default, lead to increased outsourcing of contractors to deliver the required services. The current administration’s emphasis on building infrastructure will open opportunities for private sector contractors in construction. Furthermore, the decreased regulatory environment will reduce the compliance burden and costs on private contractors—making it easier for private sector companies to contract for the government.

Government organizations are prone to procurement fraud.

Procurement fraud is a risk everyone needs to mitigate

Unfortunately, fraud and corruption around the procurement of contractors is all too common. PwC’s 2018 Global Economic Crime and Fraud Survey found that 49% of organizations globally said they’ve been a victim of fraud and economic crime, and 52% of all frauds are perpetrated by people inside the organization. Worse yet, the Association of Certified Fraud Examiners’ (ACFE) bi-annual fraud survey finds that the median loss from a single case of occupational fraud in the United States is $120,000.

Given these startling statistics, if you think that you don’t have fraud occurring today, there is a good chance you aren’t looking for it in the right places.

What is the impact of fraud and corruption in your organization?

Procurement fraud brings a number of risks, but here are some critical areas where you’d see an impact:

- Financial costs can be easily measured when it comes to fraud. In government, you also suffer the lost opportunity of redirecting those public funds to other services to support your constituents and fulfill your mission.

- Reputation damage might be your greatest cost, whether you’re talking about 0.1% or 10% of your budget lost to fraud. Public trust in your organization’s ability to manage public funds can be quickly dissolved. The best legacy and the cleanest record can be instantly ruined by a scandal.

- Public health and safety risks occur when services or goods delivered by contractors don’t meet requirements or follow policy. From poor construction, sub-par goods, or services not being delivered, there are several ways your citizens’ safety and health can be jeopardized.

How well can you spot procurement fraud indicators?

Common types of procurement fraud indicators

Pay-to-play schemes, undelivered services, broken labor laws, and theft of classified documents are just a few of the actions that have put contractors—and the governments they work for—into the harsh spotlight of recent news. The best approach to detecting issues quickly is to make sure you have knowledgeable employees, including auditors, inspectors, and examiners who are identifying and prioritizing key vulnerabilities within your processes.

“The more efficient you are at exposing and assessing indicators, the better you are at uncovering and preventing fraud.”

We’ve gathered five very common types of procurement fraud and created tests using data analytics to identify potential issues.

1. Bid rigging

This occurs when bidders agree to eliminate competition in the procurement process, thereby denying the public a fair price. There are several types of schemes with applicable tests.

Test: Look for bids where competitors withdraw higher bids, where there’s unusually high bids from some competitors with only one low bid, or for instances with only one competitor in a bid. Analyze contract awards over time to see if contractors are awarded equal amounts—which may be an indication of bid rotation.

2. Bribes, gifts, or kickbacks

This happens when a procurement or government official receives something of value to influence a pending decision. Bribery can be difficult to detect, but there are a few red flags you can test for.

Test: Look for separation of duties between procurement, purchaser, and other decision makers. Analysis of the payment text for keywords like “consulting fee”, “special payment”, “one-time payment”, “processing fee”, can often uncover suspicious transactions. Additionally, make sure you have a conflict compliance program in place where any employee receiving a gift must register it. You can then review these gifts to ensure they meet your compliance requirements.

3. Split purchases

This occurs when an individual splits a single large purchase into multiple smaller purchases to make sure they fall below the bidding and upper-level approval thresholds.

Test: Look for purchase orders with the same vendor/material/creator that occur within a certain number of days from each other.

4. Phantom vendors

This is when an employee submits invoices from a non-existent vendor.

Test: Analyze your transactions for vendors with similar sounding names, vendors and/or employees with matching addresses, invoices that are just below the threshold for additional approval, and frequent changes to your vendor master file where payment is re-directed.

5. False claims

This is when a contractor submits an invoice where no goods or services are provided.

Test: Look for duplicate purchase orders with the same vendor, same materials, same services, or identical quantities within a specific time frame that have repeat even-dollar transactions.

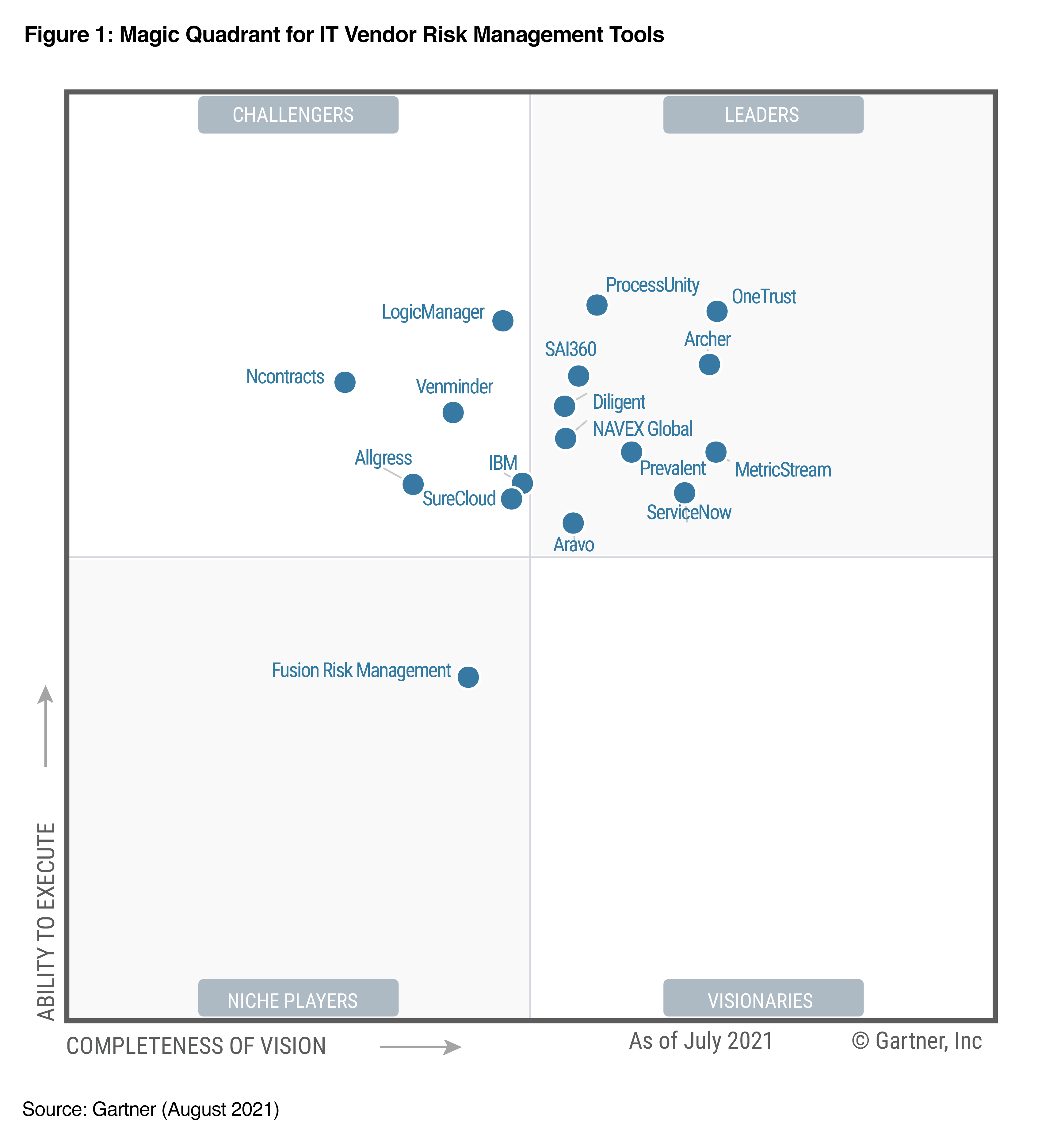

Technology improves third-party risk management

Third-party risk management technology helps organizations manage risks in ways that more traditional approaches can’t. Once the third-party management process framework is established, automated workflows and monitoring transform processes, reducing resource requirements. Organizations also significantly reduce the risk of damage from third-party relationships. This provides easy justifications for changing traditional third-party management processes and embracing an automated technology-driven approach.

eBook

Automating Fraud Detection: The Essential Guide

You’ll learn about:

- The role of data analysis in fraud detection

- Automation of fraud detection analytics and continuous monitoring

- Fraud tests for key business process areas.