Fraud management software

FraudBond helps you manage robust anti-fraud or anti-bribery programs from detection through to case resolution—to protect your organization’s integrity and to meet your anti-fraud compliance obligations.

Best-practice workflows, data analytics, defensibility, and a risk-based approach.

Fraud is a reality for every organization—from governments and banks to healthcare and manufacturing. The best way to reduce your fraud risk exposure is by identifying unusual activity early, weeding out false positives fast, and taking action before that activity grows into a bigger problem.

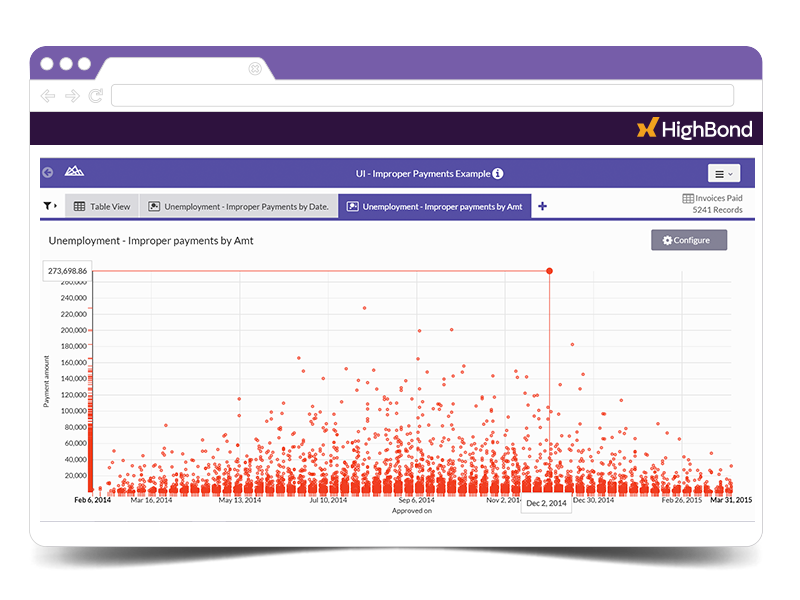

FraudBond gives you the ability to detect and prevent fraud to reduce your overall risk exposure. It consolidates and analyzes your data to find red flags. Robotic data automation helps you spot and map fraud trends so you can shut them down immediately and quickly weed out false positives.

Why choose FraudBond?

Examine 100% of your transactions so no incident is missed and find fraud before it causes serious damage.

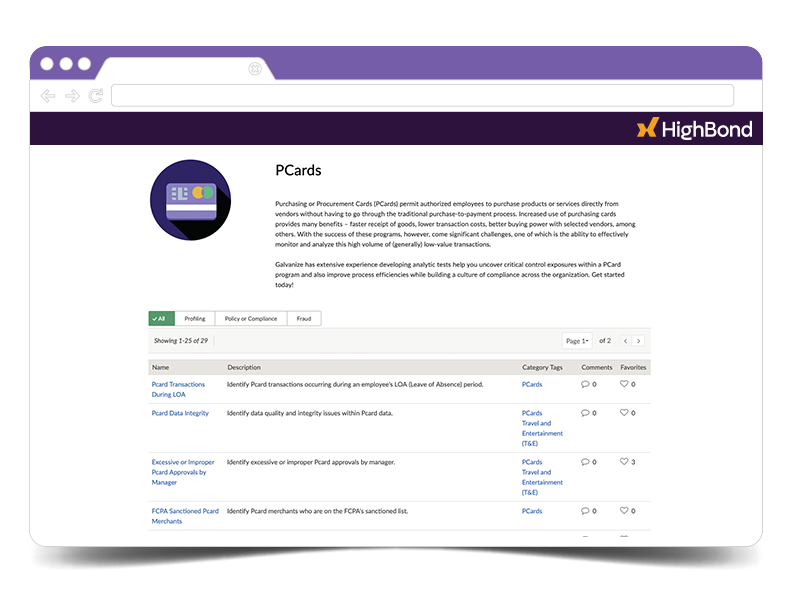

Get started fast with fraud analytic libraries and tools that incorporate best practices for a range of industries.

Spend less time on acquiring data and weeding out false positives so that you can spend more time stopping fraud and corruption.

Streamline your anti-bribery and anti-corruption compliance by directly connecting policies, controls, and monitoring programs.

Don’t ever lose critical fraud investigation evidence. Unlike spreadsheets, keep your evidence all in one place, supported by complete audit trails.

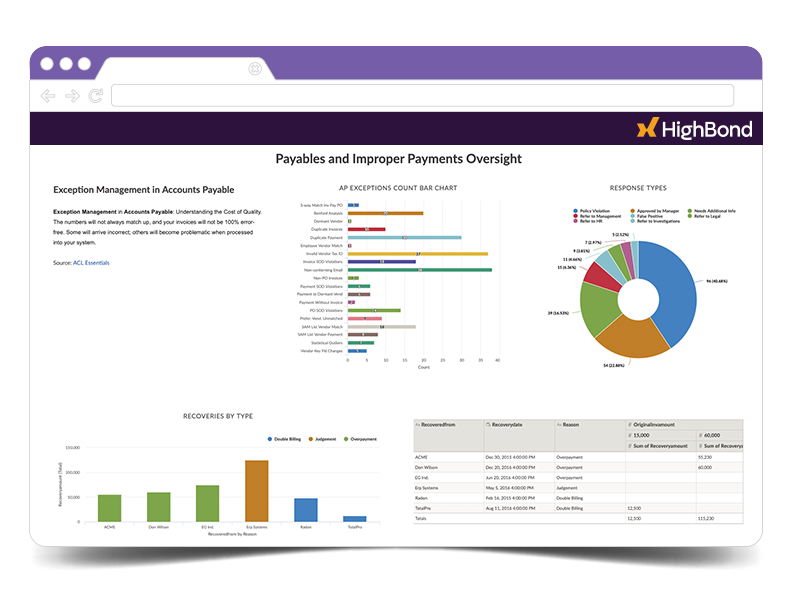

Total program oversight

- Assess and monitor control weaknesses to reduce fraud and corruption risk.

- Develop external oversight of ERP controls.

- Consolidate regulations and standards to manage regulatory programs for anti-bribery, anti-corruption (e.g., FCPA, SAPIN II), and financial crimes (AML).

- Record, investigate, and report on fraud tips with anonymous whistleblower hotlines.

- Capture policy and training attestation with employee and third-party questionnaires on topics like IT security, COI, COC, and SoD.

Automated fraud monitoring analytics

- Apply a risk-based approach to your fraud programs.

- Easily connect to internal and external data sources and automate analysis for continuous monitoring.

- Apply advanced analytics and machine learning techniques to identify trends and high-risk activities.

- Flag violations, automate follow-up, and notify key stakeholders to address fraud before it grows.

- Refine your analytics and monitoring programs to focus on higher-risk fraud and to reduce false positives.

- Take advantage of hundreds of pre-written analytics, including best practices used by the experts, to get a head start on your program.

Issue escalation, case management, & investigations

- Automate issue escalation and case management with workflow rules and triggers.

- Use task assignment and routing capabilities to configure review assignments and capture notes and activities.

- Contact stakeholders to collect evidence or input to close-out flagged records and resolve cases.

- Record a defensible evidence trail to support investigations.

- Create one-click reports and dashboards to keep your stakeholders informed.

See how FraudBond can work for you.

Thanks for reaching out!

Your inquiry is now on its way to be processed and channeled to the best person to answer your questions. Once it lands in their inbox, they’ll be in touch.