Getting financial forecasts accurate is critical to all finance leaders. Learn how Keith Bailey, VP of finance, Galvanize, uses our GRC platform, HighBond, to deliver confidence in his risk analysis and performance reporting.

Many new finance leaders face an immediate challenge of navigating multiple systems and spreadsheets to prepare for their first board meeting.

Thankfully, that wasn’t the case for me. When I was originally appointed Finance Director at Galvanize in 2017, I was pleased to learn Galvanize was using its own software. In HighBond, I had an invaluable resource for interrogating our data—from all our systems.

I regularly use HighBond to illuminate financial risk and performance, and make my financial forecasts easier to produce. Here’s how.

Storyboards improve financial forecasts

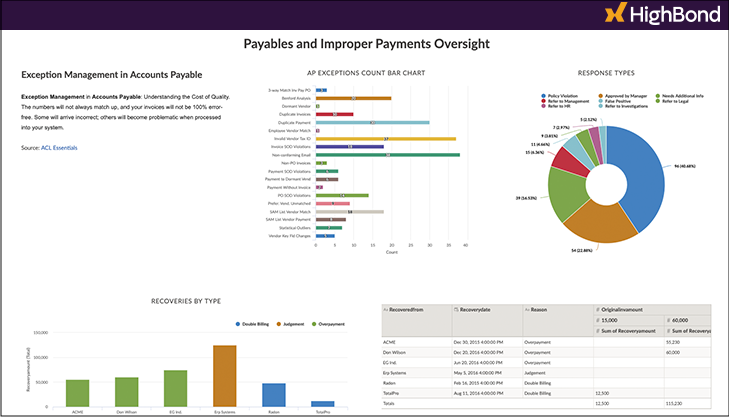

I use HighBond to create reliable financial forecasts for the board and the senior leadership team. Whether it’s revenue, EBITDA, or free cash flow, I make sure automatic analytics “clean” the datasets.

I’ve got a suite of dashboards (storyboards), KPIs, and alerts set up to monitor key finance metrics in near real time. If we get too close for comfort, an alert is sent to myself, our CEO, and key members of my team. We also use storyboards to monitor other important metrics, like the “rule of 50” and opex vs. earned revenue.

On each storyboard, I can add comments—which avoids ad-hoc explanations in management meetings. We spend our time discussing how to respond to a metric, rather than bringing people up to speed with the content.

Storyboards in HighBond make it possible to quickly view and make sense of large amounts of financial data.

Why technology makes a difference

It boils down to two areas: getting access to important information and trusting the data’s accurate.

Access data from any and all systems

Using connectors and commands, I can access all the data in our systems. Yes, really, all of them! Like most businesses, we have a number of systems, which means our data resides in multiple places. Being able to break down those silos and access whatever information I need to have confidence in the visibility and control of our key risks, is really valuable. I talk about this more in a previous blog post, Big data analytics for finance leaders.

“The biggest impact for me is that I have confidence in the forecasts I’m presenting.”

Automatically updated data

Once I choose the information sources (e.g., general ledger or invoice data, or HR/payroll information), I determine which data is most relevant. (That’s just a case of selecting columns in a table so the platform knows which bits of data to copy.)

The connections I make to those columns are permanent (unless I switch them off). That means the copies of the data refresh automatically and are stored on an access-restricted secure server. This means I’ve got secure data in one place, which again makes a huge difference to my day. No more linking/merging spreadsheets, or version control headaches that result from spreadsheets being emailed around.

Tests on our controls are scheduled to run daily, weekly, or monthly. These tests automatically flag anomalies as they occur, so my team has a longer lead-time to address them ahead of month-end.

More confident financial forecasts

The biggest impact for me is that I have confidence in the forecasts I’m presenting. I’m able to spend the day or two before a leadership meeting refining the message, rather than scrambling to obtain a solid number. This helps me feel in control and be confident in the financial story I’m telling.

Less stressful quarter-ends

And that sentiment has filtered down to my team. They’ve often told me month- and quarter-end are less stressful, because a lot of the anomalies are picked up earlier. Of course, there’s still pressure to produce the final numbers and resolve last-minute issues. These are inevitable, and it would be unrealistic to expect that to go away entirely. But I’m glad I’m in an environment where most of those issues are eliminated automatically. It just makes my job, and the jobs of my team, that much easier.

eBook:

Balancing risk control & productivity

You’ll learn:

- How to illuminate risks in finance and accounting systems.

- Seven performance hacks to improve risk management and performance.

- How to understand the gaps in your ERP Systems.